W.emacromall.com

MArch 2015

The 2014 Drug TrenD reporT

Commercially Insured Year in Review

Medicare Year in Review

A Look at Overall Drug Trend for 2014

A Look at Medicare Overall Drug Trend for 2014Medicare: Traditional Therapy Classes and Insights

Therapy class revIew

Top 10 Medicare Traditional Drugs

Comparison of Medicare and Commercial Trend: Traditional Therapy Classes

Commercially Insured: Traditional Therapy Classes and Insights

Medicare: Specialty Therapy Classes and Insights

Top 10 Traditional Drugs

Top 10 Medicare Specialty Drugs

Commercially Insured: Specialty Therapy Classes and Insights

Comparison of Medicare and Commercial Trend: Specialty Therapy Classes

Top 10 Specialty Drugs

MeDIcaID

2015-2017 TrenD forecasT

Medicaid Year in Review

Spend for Traditional Drugs in the Next Three Years

A Look at Medicaid Overall Drug Trend for 2014

Spend for Specialty Drugs in the Next Three Years

Medicaid: Traditional Therapy Classes and Insights Top 10 Medicaid Traditional Drugs

Medicaid: Specialty Therapy Classes and Insights

Patent Expirations

Top 10 Medicaid Specialty Drugs

The Express Scripts Prescription Price Index

The Drug Trend Report MethodologyCitations

coMMercIally InsureD year

In revIew

2014 Drug TrenD requires unpreceDenTeD AlignmenT AnD AcTion

or nearly three decades, Express Scripts has delivered innovative solutions that have helped contain rising medication costs for our clients and members.

F Annual drug spending increases have often been below the annual rate of overall

healthcare inflation in the U.S. Throughout this period, achieving the industry's lowest drug trend while still maintaining patient safety – as Express Scripts has done time and time again – has been neither accidental nor easy. Rather, it was the intentional result of our clients taking action and joining us as partners. The aggregate effect of our collective partnership has been to make the use of prescription drugs safer and more affordable.

In 2014, the pharmacy landscape underwent a seismic change, confronting healthcare payers with the highest annual increase in drug spend since 2003. New treatments for nonorphan conditions like hepatitis C were introduced in the U.S. market at exorbitant, orphan-drug pricing. Compounding pharmacies began exploiting a loophole in a new regulation that made the creation and dispensing of unproven topical creams a lucrative cottage industry. Drug manufacturers – brand and generic alike – continued to consolidate, placing additional strain on the supply chain to handle temporary shortages. The pipeline of

The aggregate effect of our collective

new medications to treat conditions like cancer and high blood cholesterol also threatened to undermine the sustainability of the U.S. pharmacy benefit.

partnership with clients has been to

These challenges are unprecedented, and the need to respond has never been greater.

make the use of prescription drugs

However, plan sponsors can no longer rely on the wave of less-expensive generics to control drug costs. They need to act now to more tightly manage the benefit, implement smarter

safer and more affordable.

formularies, control the use of compounded medications and offer clinical support to ensure that all patients are able to achieve the best health outcome possible.

To sustain a meaningful pharmacy benefit, payers must team with a pharmacy benefit manager (PBM) with the strength and scale to challenge the status quo, the flexibility and thoughtfulness to adapt to the evolving marketplace, the curiosity to explore new solutions, and the drive to make pharmacy care in America smarter. Express Scripts is dedicated to expanding both access and affordability, so that every patient receives the right medicine at the right time and at a fair cost. We are prepared to lead and make a difference.

DynAmic, complex phArmAcy chAllenges loom lArge

To sustain a meaningful pharmacy benefit, payers must team with

The challenges facing plan sponsors include the pipeline of niche drugs, orphan-drug

a PBM with the strength and scale to challenge the status quo,

pricing for nonorphan drugs, new innovations in commonly used therapy classes, cost

the flexibility and thoughtfulness to adapt to the marketplace, the

inflation for compounded medications and industry consolidation.

curiosity to explore new solutions, and the drive to make pharmacy

Pipeline of Niche Drugs

care in America smarter.

Historically, drug manufacturers' business models focused on research and development of key drugs to treat common conditions that affected millions of patients. These branded medications became blockbusters because of the volume of patients treated and a high,

Orphan-Drug Pricing for Nonorphan Drugs

but not exorbitant, price tag. As a result of patent expirations, generic competition and

Orphan drugs are among the most expensive medications in the U.S., often costing tens

a withering pipeline of broad-reaching drugs, manufacturers are shifting their drug

of thousands of dollars per prescription. These medications treat extremely rare conditions

discovery, development and pricing strategies. Now, manufacturers are increasing their

and diseases with very small, very specific populations – typically only several thousand

focus on medications that treat small subsets of patients with diseases like cancer, or

patients or fewer. The high price tag is necessary – and justified – to fund manufacturer

patients with rare diseases such as hereditary angioedema.1

research and development costs for these and future medical breakthroughs that might not otherwise happen.

Manufacturers also are tailoring molecular drugs to patients with specific genetic profiles known to be affected by certain diseases, so the drugs are more effective in treating those

One example, approved by the U.S. Food and Drug Administration (FDA) in late 2014, is

specific patients. For example, Ruconest® (C1 esterase inhibitor [recombinant]), approved

Harvoni® (ledipasvir/sofosbuvir), which is indicated for patients with genotype 1 of the

in July 2014, treats adult and adolescent patients with hereditary angioedema, a condition

hepatitis C virus. In the U.S. alone, there are an estimated three million patients with

that affects fewer than 10,000 Americans. Another such drug, Cerdelga™ (eliglustat),

hepatitis C – far beyond the 200,000-patient threshold that the FDA uses pursuant to the

offers an oral alternative to enzyme replacement therapy for adult patients with Gaucher

1983 U.S. Orphan Drug Act – to qualify an orphan-disease population.2 Despite its potential

disease type 1, an inherited lysosomal storage disorder that affects approximately 6,000

to treat millions of patients, Harvoni is priced at a staggering wholesale acquisition cost of

patients in the U.S.

$1,125 per tablet – more than $33,000 per 30-day prescription.

In addition, more than 1,000 targeted cancer treatments, many genetically guided, are

These new treatments for hepatitis C are just one

in development. One such niche cancer drug that recently received approval is Keytruda®

example of nonorphan drugs with orphan-drug price tags.

(pembrolizumab), an immunotherapy approved in September 2014 to treat a small

Rewarding pharmaceutical breakthroughs is undeniably

subpopulation of patients with certain genetic expressions of advanced, non-small cell

important to the discovery of future treatments and cures;

lung cancer. Keytruda and other niche drugs have the potential to vastly improve outcomes

however, payers and patients have limited resources

and are often clinical game changers. They typically have little or no competition and

and simply cannot afford these prices. Absent more fair

are often much more effective than the broader-spectrum drugs they are replacing as

drug pricing, payers will face half a trillion dollars in

first-line or second-line treatments. Many come with unprecedented price tags, however,

prescription drug costs as soon as 2020.

as pharmaceutical companies try to maintain profit margins and recoup their investments in drug discovery.

New Innovations in Commonly Used Therapy Classes

High blood cholesterol – a therapy class currently dominated by low-cost generics – also

Despite the recent focus on the development and promotion

is poised for significant cost increases in the coming years. New medications that inhibit

of specialty medications, there is still a considerable drug

proprotein convertase subtilisin/kexin type 9 enzyme, known as PCSK9 inhibitors, are

market for medications indicated to treat more common

currently in development with a primary indication for the treatment of a genetic disorder

chronic conditions, such as diabetes and high blood

called familial hypercholesterolemia. This inherited condition leaves the body unable to

cholesterol, which combined affect at least 19 million

remove low-density lipoprotein (LDL) cholesterol from circulation, causing cardiovascular

Americans.3 Although both chronic conditions have well-

disease to develop early in life.

established treatment regimens, many of which have

These new biologic products inhibiting PCSK9 represent a novel way to lower cholesterol

generic equivalents, recent approvals and innovative

and may offer additional treatment options for those patients with very high LDL

pipelines will increase current and future drug spend.

cholesterol levels. Although PCSK9 inhibitors may initially be used in patients with familial

Diabetes medications were the only nonspecialty therapy class to have a significant

hypercholesterolemia and in those who cannot tolerate statins, their potential for expanded

increase in per-member-per-year (PMPY) drug spend in 2014, largely due to two newly

uses as adjunct therapies to lower LDL in general could impact drug spend significantly.

approved medications known as sodium-glucose co-transporter 2 (SGLT2) inhibitors.

Projected to command an annual cost of $10,000 or more per patient, they eventually could

SGLT2 inhibitors work with the body's natural processes to remove excess glucose from the

be used as a chronic therapy for a large portion of the 71 million patients in the U.S. with high cholesterol.5

bloodstream. The FDA approved the first SGLT2 inhibitor in 2013, two more were approved in 2014 and many more are in the development pipeline.

Cost of Inflation for Compounded IngredientsIn 2013 and 2014, spend for compound medications escalated rapidly. Compounded drugs

The diabetes pipeline also includes once-weekly oral and injectable treatments that

now rank as the third-most-expensive therapy class on a PMPY basis, displacing high blood

demonstrate greater clinical efficacy than currently available therapies, as well as drugs

pressure medications, which had ranked among the top three most-expensive traditional

with new mechanisms of action aimed at regenerating insulin-producing cells.4 In addition,

therapy classes for at least a decade. Compounding was the primary manner in which

we anticipate insulin medications such as Lantus® (insulin glargine) will soon compete

prescriptions were prepared until the 1950s, but mass pharmaceutical production had

with next-generation biosimilar insulins from several pharmaceutical manufacturers, likely

supplanted this method by the 1970s. The volume of compounded prescriptions continued

spurring the escalation of costs for insulin medications that occurred in 2014.

to drop over time, representing less than 1% of all prescriptions by the early 2000s,6 and their share is similar today.

Diabetes medications were the only nonspecialty therapy class

The reasons for the current increases in the cost and utilization of compounded medications are complex. Key factors include changes in industry practices that make it easier to

(aside from compounded medications) to have a significant

track the costs of these medications, marketing and billing practices of compounding

increase in PMPY spend. We anticipate that insulin medications

pharmacies, physician prescribing and patient demand. Compounding practices are

such as Lantus® (insulin glargine) will soon compete with next-

regulated under the Food and Drug Administration Modernization Act of 1997 (FDAMA).7

generation biosimilar insulins from several pharmaceutical

Drug compounders are not required, however, to demonstrate the safety, efficacy, strength,

quality or purity of their products – as producers of commercially manufactured drugs must do. Moreover, pharmacies are not required to report compounding-related adverse events to the FDA or, as currently required in only a few states, to the state boards of pharmacy.8

An effort toward increased transparency, in fact, began fueling the current increase in

innovATive heAlThcAre soluTions Drive BeTTer heAlTh AnD

trend for compounded medications. In 2012, an updated version of the Health Insurance

Portability and Accountability Act (HIPAA) standard for pharmacy claims transactions –

Through the technology and talent at work in the Express Scripts Lab, expanded in 2014, we

National Council of Prescription Drug Plans (NCPDP) Telecommunications Standard Version

turn data into insights and insights into proven solutions at an even faster pace. We study,

D.0 – was implemented. One component of this standard was the requirement that all

in real time, how patients interact with their healthcare providers and their medications.

components of compounded drugs be specified and billed using average wholesale price

Using these insights, we rapidly translate research findings into practical applications

(AWP) at the ingredient level, rather than being rolled up under the highest-priced ingredient

and proven solutions that address our members' and plan sponsors' most pressing needs.

according to previous claims and billing standards.9 Since then, bulk manufacturers and

By keeping our clients and members at the center of everything we do, we align our interests

compounding pharmacies have substantially raised AWP prices for the components of

to make the use of prescription medications safer, more affordable and more accessible.

many compounded drugs, creating unsustainable cost increases.

National Preferred Formulary

Today, most therapy classes offer more drug choices than ever. But the downside of today's

The wave of billions of dollars' worth of brand blockbuster medications losing patent

pharmacy climate is that many prescription drugs cost more but deliver no additional

protection in the past few years has led to unprecedented availability of generic drugs, while

health benefit. Smart formulary management is therefore vital to preserve patient access

the resulting competition among manufacturers and suppliers of new generic medications

and choice while ensuring that payers can obtain fair and affordable pricing. By excluding

drove down drug costs substantially in most of the top therapy classes. But, the pace

a group of "me-too" products from the Express Scripts National Preferred Formulary (NPF),

of price reductions has begun to slow: generic prices for the most commonly used drugs decreased 20% from 2013 to 2014, compared to the 30% drop seen from 2012 to 2013. And some generic drugs, for example, doxycycline and oxycodone, available generically for

plan cosT for IMpacTeD Drugs for clIenTs who DID anD DID noT

many years, experienced considerable price increases in 2014.

aDopT The naTIonal preferreD forMulary In 2014

The most significant contributing factor was consolidation in the supply chain as a

PMPM Plan Cost for IMPaCted drugs by Month

result of merger and acquisition activity among pharmaceutical manufacturers and drug

distributors. Fewer manufacturers means less competition and increased prices. There

now is only one – or at most, two – generic manufacturers of some specific products, for example, digoxin, when there used to be five or six producing a medication. According to

analysts, just three generic drug companies were responsible for almost half of the revenue

generated by all generic drugs in 2013.10 This industry consolidation will continue to be a challenge for payers; but the good news is that, on the whole, generic medications continue

to deliver significant cost savings.

NPF Implementation

Did Not Adopt the National Preferred Formulary

Adopted National Preferred Formulary

we have the necessary leverage to negotiate more effectively with manufacturers and

coMparIson of TraDITIonal Drug TrenD In clIenTs who DID

ultimately achieve lower drug prices for our clients and patients. And in the rare instance

anD DID noT IMpleMenT our coMpounDeD Drug uTIlIzaTIon

when a patient has a medical need for an off-formulary drug, we have a pathway for the

ManageMenT (uM) soluTIon

excluded drug to be covered for the patient.

In January 2014, we moved 48 products to "not covered" status for our 2014 NPF, which is the selected formulary for approximately 30% of our members. The products that

we removed represented only about 1% of all the products currently on our formulary, and

were used by fewer than 3% of our members. Importantly, each of these products had clinically equivalent alternatives on the market that remain on our formulary. This effort at

cost control without sacrificing patient health paid off for plan sponsors who adopted the

2014 NPF: drug costs in the affected therapy classes decreased on average 3.9% over the same time period in 2013 (see chart on previous page). Among plan sponsors who didn't

adopt the new standards, however, drug costs in the same therapy classes increased on

Clients Who Implemented UM

Clients Who Did Not Implement UM

average 7.2% over the first 6 months of 2013.

Our 2015 NPF excludes only 74 drugs out of 4,800 that were available on the market on the

before the compound-management solution was offered, plan sponsor spend for

first day of the year. As a group, plan sponsors who adopt the 2015 NPF will save more than

compounded medications was 276.9% greater than spend for the same period in 2013.

$1 billion for the year. In the U.S. healthcare industry – where government does not set price

By contrast, after the four-month period post implementation of the compound-management

limits on medications and consumers are not exposed to the full price of those medications

solution, the growth in plan sponsor spend had slowed to 128.4%.

– smart formulary management is one of the few ways to swing the balance of power from

The chart above shows the solution's monthly impact by comparing the traditional drug

pharmaceutical manufacturers to those who pay for healthcare: health plans, employers,

trend for commercial plan sponsors that chose to actively manage compounded drugs and

taxpayers and individual patients.

the trend for those that did not. In September, the traditional trend for the sponsors that

Compounded Drugs

began actively managing compounded-drug spend was 6.6%, compared to a trend of 7.5%

Compounded drugs often cost more than similar

for plan sponsors that were either waiting to implement the program or did not intend to

FDA-approved medications, but are not necessarily

implement the program.

more effective. In response to skyrocketing plan costs

Compounded-drug spend continued to decrease among clients that were actively managing

for compounded drugs, Express Scripts developed

their spend for these drugs. By December 2014, the traditional trend for clients who had

a comprehensive compound-management solution

Drug Trend Before

implemented the management solution was 4.5%, a decrease of 2.1 percentage points

that evaluates all ingredients used in compounded

over the four-month period, while it was 7.7% for clients who had not. By continuously

drugs to identify needless cost and waste, actively

monitoring for clinically unproven ingredients used in compounded medications, the

manages the use of compounded drugs and blocks

solution has eliminated the majority of unnecessary spend for these medications with

more than 1,000 clinically unproven ingredients. This solution had a significant and

minimal patient impact.

immediate impact on drug spend in 2014. For the first eight months of the year,

Actions to Establish More Fair Drug PricingThroughout 2014, Express Scripts was largely critical of a recent trend of drug manufacturers: bringing products to market that, while innovative, are priced so high that payers could not sustain the burden. The leading example was the hepatitis C treatment Sovaldi® (sofosbuvir), whose cost of $84,000 threatened to bankrupt both private and public plan sponsors around the United States. Never before had a drug to treat a population so large been priced so high. Clients and patients needed a champion, and Express Scripts took action.

After a year-long campaign advocating for more fair drug pricing, Express Scripts announced in December a new agreement with AbbVie, makers of the new hepatitis C medication Viekira Pak™ (ombitasvir/paritaprevir/ritonavir packaged with dasabuvir). The unprecedented arrangement addresses both affordability for payers and access for patients. The cost to cure is now low enough that plan sponsors can afford to treat all hepatitis C patients with genotype 1, not just the sickest.

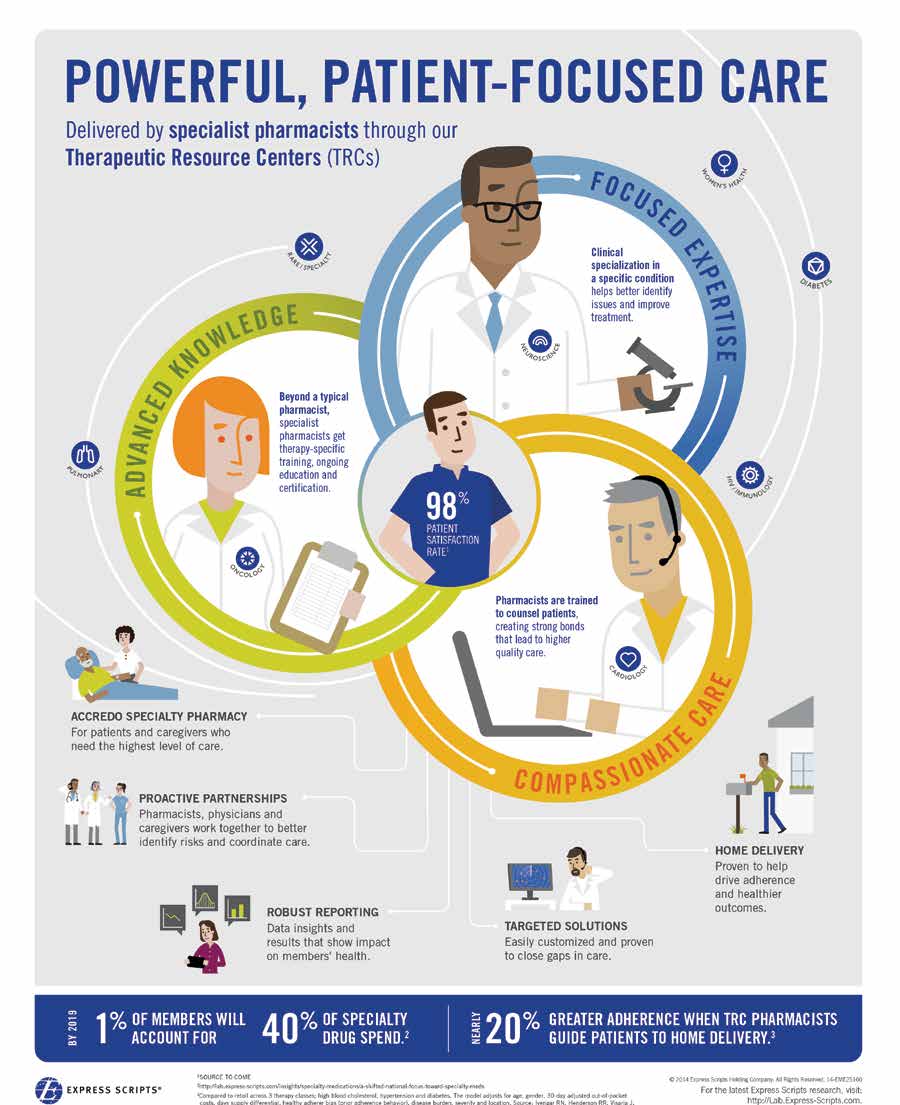

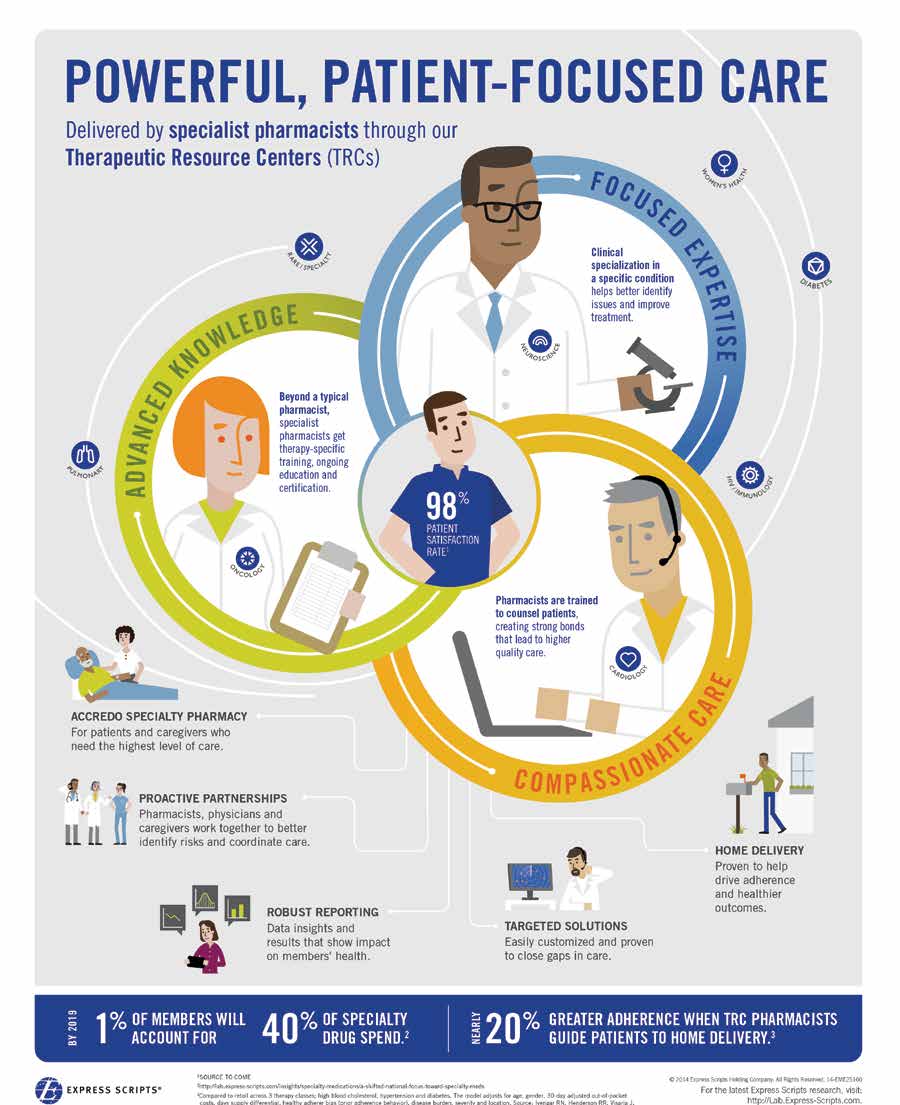

Therapeutic Resource CentersThe clinically specialized Therapeutic Resource Centers (TRCs) of the Express Scripts PharmacySM and Accredo Specialty Pharmacies deliver superior treatment outcomes and cost-effectiveness by supporting patients through the challenges of complex and costly diseases. Our specialist pharmacists and nurses each receive clinically specialized training in one disease state, and the work they do focuses almost exclusively on that clinical condition. This specialized expertise and commitment enables an optimal patient experience and ensures the highest performance in pharmacy safety, improved medication adherence and closing gaps in care. With their highly specialized knowledge of the complex disease states and complicated treatment protocols they manage, these TRC pharmacists and nurses often have more experience in rare conditions than some of the physicians who prescribe the treatments. For example, the Multiple Sclerosis (MS) Therapeutic Resource Center® manages 72,000 patients with MS, whereas the typical neurologist might have only a few MS patients in his or her entire practice.

TRCs are responsible for interacting with millions of members each year, and each interaction is an opportunity to provide expert clinical counseling, reconcile a drug safety issue or close a gap in care. Annually, the TRCs are involved in over 30 million clinical interactions and close more than 4.8 million gaps in care. Accredo's Hepatitis Therapeutic Resource Center®

delivers the industry's highest level of successful therapy completion, which is critical to a patient's avoiding future virus resistance. In addition, Express Scripts research suggests that patients who received care through the Express Scripts Therapeutic Resource Centers had between 11% and 19% better adherence to oral diabetes, hypertension and statin medications than patients at even the highest-performing retail pharmacies.11

Managed vs. Unmanaged ClientsBalancing patient access and costs is a challenge for every payer, given the volume of therapeutic options available and the variety of conditions those medications treat. Leveraging decades of clinical experience and innovation, Express Scripts'

research-driven, state-of-the-art clinical programs and management solutions help optimize drug utilization and costs.

We examined the impact of multiple utilization-management and cost-management strategies on traditional drug spend in 2014.12 Strategies such as drug tier levels, step therapy programs, out-of-pocket pay differentials, formulary management and utilization of home delivery from the Express Scripts Pharmacy were considered. In the study, plan sponsors were categorized into one of three groups based on the type of network-management and utilization-management programs they implemented as part of the pharmacy benefit:

• Unmanaged — Plan sponsors who did not implement any, or who implemented only

one utilization-management or cost-management program

• Managed — Plan sponsors who implemented two or three of the five network-

management or utilization-management programs offered

• Tightly managed — Plan sponsors who implemented four or five of the network-

management or utilization-management programs offered

Compared to unmanaged plans, tightly

The results showed that "unmanaged" plans experienced an annual average increase in PMPY spend for traditional medications of 4.1% in 2014, whereas "tightly managed"

managed plans spent 27.6% less on

plans' traditional drug spend increased only 0.3%. Compared to unmanaged plans, tightly managed plans spent 27.6% less on traditional drugs per member in 2014.

traditional drugs per member in 2014.

a look aT overall Drug TrenD

verall drug spend increased 13.1% in 2014, following several years of declining

coMMercIally InsureD: coMponenTs of TrenD

rate increases. Market forces and changes in patient behavior impacted drug

O expenditures in 2014, but brand drug cost was one of the most important 2014

factors driving trend, especially for specialty medications.

pMpy spenD

unIT cosT

Drug trend comprises two main components: utilization and unit cost. The utilization of

traditional prescription medications decreased marginally (0.1%) from 2013 to 2014, but

the use of specialty medications increased 5.8%. Unit costs – the costs of the medications

themselves – drove spending for both traditional and specialty medications higher by

January-December 2014 compared to same period in 2013

6.5% and 25.2%, respectively. The 13.1% overall trend was composed of a 6.4% increase in spend for traditional (nonspecialty) medications and a 30.9% increase in spend for specialty medications, the highest specialty drug trend ever recorded. Specialty medications

TraDITIonal, specIalTy anD overall TrenD

continued to contribute an ever-increasing share of total spend (31.8%, up from 27.7% in 2013) that is expected to reach 44% in the next three years. (Note: Roughly half of specialty

2006 to 2014

medication drug costs are billed through the medical benefit and therefore are not included

in our trend calculation.)

Overall Drug Trend

Traditional Drug Trend

Specialty Drug Trend

Therapy class revIew

TherApy cl Ass review

coMMercIally InsureD: TraDITIonal Therapy classes anD InsIghTs

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

pMpy spenD

unIT cosT

High Blood Cholesterol

High Blood Pressure/Heart Disease

Heartburn/Ulcer Disease

Attention Disorders

or the fourth consecutive year, medications used to treat diabetes were the most

remained among the top three therapy classes, high blood pressure medications dropped from

expensive traditional therapy class when ranked by per-member-per-year (PMPY)

number three to number five as compounded drugs rose in rank to the third most expensive

F spend. Additionally, the diabetes class had the largest trend with the exception of

therapy class and pain/inflammation moved up from number nine to number four.

compounded drugs – which jumped into third place – largely due to a 128.2% unit cost trend.

Utilization, which increased less than 1.0% in two of the top 10 traditional classes

Total trend was negative for half of the top 10 therapy classes (high blood cholesterol, high

(compounded drugs and pain/inflammation), was up modestly in another three (diabetes,

blood pressure/heart disease, heartburn/ulcer disease, asthma and depression), stemming

attention disorders and depression). At the same time, unit costs decreased in five

from declines in utilization, unit cost or both among the different classes.

traditional classes (high blood cholesterol, high blood pressure/heart disease, heartburn/

The top three therapy classes (diabetes, high blood cholesterol and compounded drugs)

ulcer disease, asthma and depression). This pattern generally reflects the continuing

contributed 28.8% of traditional drug spend in 2014. Although high blood cholesterol drugs

genericization of commonly used therapy classes.

TherApy cl Ass review

• The increase in spend for compounded medications in 2014 represented a staggering

change from 2013, when compounded medications did not appear among the top 10 therapy classes. Compounded drugs strongly drove 2014 traditional trend; if excluded from the analysis, total traditional trend would have been only 2.3%.

• Another driver of positive trend among traditional therapy classes was diabetes. Trend

was 18.0%, primarily from a 16.3% increase in drug costs. Much of the increase was due to continued brand innovation and brand inflation. Drug cost increases have been particularly significant among insulins, such as Lantus® (insulin glargine [rDNA origin] injection) and Levemir® (insulin detemir [rDNA origin] injection). Because insulins are manufactured by biological processes, true generics for them are not possible. But biosimilar formulations being developed are expected to cost between 20% and 40% less than the branded innovators.13 At least some of the increases in price for currently available insulins may have been a result of the upcoming patent expiration for Lantus and the uncertainty around biosimilar activity in the diabetes space.

• Utilization for medications used to treat high blood cholesterol decreased 2.9% after

a 2.1% decrease in 2013. In addition to market saturation of generics for the most commonly used drugs, the decline may also be related to the ongoing impact of low-cost generic programs offered by retail pharmacies.

If compounded medications were

• Total trend for traditional asthma medications was -14.9%, driven by drops in utilization

excluded from the analysis, total

(3.2%) and unit cost (11.6%). The decrease in utilization is likely related to market movement toward specialty asthma medications such as Xolair® (omalizumab). Lower unit

traditional trend would have been

cost is due mainly to lasting impact from the August 2012 patent expiration of Merck's Singulair®. The generic, montelukast, captured 33.4% of the asthma market in 2014.

just 2.3% instead of 6.4%.

• In addition to a small increase in utilization compared to 2013, the 15.7% increase in

unit cost resulted in a 16.0% spend increase for pain/inflammation medications. Large price increases for two commonly used drugs, generic opioid oxycodone/acetaminophen and branded Celebrex® (celecoxib), are driving unit cost trend. The cost of oxycodone/acetaminophen, which captured 7.3% of 2014 market share in the class, likely increased because of generic supply chain issues and new U.S. Food and Drug Administration (FDA) regulations limiting the amount of acetaminophen allowed in combination opioid products. Brand Celebrex increased in price prior to the launch of generic formulations in December 2014.

TrADiTionAl spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

Medications used to treat diabetes were the most expensive for the fourth

year in a row when ranked by per-

pMpy spenD

unIT cosT

member-per-year (PMPY) spend, which

was $97.68, 18.0% higher than in

High Blood Cholesterol

2013. Brand innovation continues in

this traditional therapy class. Four

new diabetes treatments – Farxiga™

High Blood Pressure/Heart Disease

(dapagliflozin), Tanzeum™ (albiglutide),

Heartburn/Ulcer Disease

Jardiance® (empagliflozin) and

Invokamet™ (canagliflozin/metformin) –

Attention Disorders

were approved in 2014. Less than half

of the prescriptions filled for diabetes

treatments were generic in 2014. Despite

the influx of new, branded medications however, three of the most commonly used diabetes treatments – metformin,

Top Drugs

generIc fIll raTe (gfr)

glipizide and glimepiride – are generic drugs with branded formulation patents

by MarKet share

that expired at least a decade ago.

Despite having the highest PMPY cost,

OneTouch® Ultra Test Strips

2014 prevalence of use for diabetes

Lantus® (insulin glargine)

medications was among the lowest for

traditional therapy classes in the top 10.

0.881NUMBER OF PRESCRIPTIONS

$110.86 AVERAGE COST

5.1% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

hIgh BlooD

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

A 3.9% decline in unit cost and a 2.9%

pMpy spenD

unIT cosT

drop in utilization contributed to an overall

6.8% decrease in per-member-per-year

High Blood Cholesterol

(PMPY) spend for high blood cholesterol

treatments in 2014. The market saturation

of generic drugs continues to fuel declines

High Blood Pressure/Heart Disease

in drug prices. In addition, one of the

Heartburn/Ulcer Disease

last remaining brand statins, Crestor®

(rosuvastatin), is set to lose patent

Attention Disorders

protection in 2016. However, a new class

of biologic products known as PCSK9

inhibitors, which is in development,

represents a novel way to lower cholesterol. Although initial approval of these agents likely will be to treat rare forms of hypercholesterolemia, their potential

Top Drugs

generIc fIll raTe (gfr)

expanded use as adjunctive therapies to

by MarKet share

reduce low-density lipoproteins (LDL) for a

wider population could impact drug spend

significantly. This will impact specialty

drug trend in the future. Atorvastatin,

Crestor® (rosuvastatin)

the active ingredient in Lipitor®, is the

most commonly used medication in

1.141 NUMBER OF PRESCRIPTIONS

$42.69 AVERAGE COST

11.0% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

coMpounDeD

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

Compounded drugs ranked in the top 10

pMpy spenD

unIT cosT

therapy classes for the first time. Since

the implementation of new regulations

High Blood Cholesterol

in 2012 requiring that all components

of compounded drugs be specified and

billed at the ingredient level rather than

High Blood Pressure/Heart Disease

being rolled up under the highest priced

Heartburn/Ulcer Disease

ingredient, bulk manufacturers and

compounding pharmacies have raised

Attention Disorders

prices substantially for the components

of many compounded drugs. The result

has been unsustainable cost increases.

If compounded drugs were excluded, traditional drug trend would have been only 2.3% (vs. 6.4%) and total overall trend would have been 10.4%

Total trend for compounded

(vs. 13.1%). Many of the compounded

by voluMe

drugs – 128.4% – was higher

medications billed under the pharmacy

benefit contained ingredients used to

than trend for any other top 10

baclofencyclobenzaprine

traditional therapy class.

progesterone micronizedpropylene glycol

0.040 NUMBER OF PRESCRIPTIONS

$1,164.12 AVERAGE COST

1.4% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

A marginal increase in utilization (0.3%)

pMpy spenD

unIT cosT

combined with a significant increase in

unit cost (15.7%) contributed to a 16.0%

High Blood Cholesterol

increase in per-member-per-year (PMPY)

spend for pain/inflammation medications

in 2014. Although generic medications

High Blood Pressure/Heart Disease

continue to dominate the class, PMPY

Heartburn/Ulcer Disease

spend has not declined in accordance.

This is because manufacturers of newer

Attention Disorders

versions of branded, tamper-resistant

formulations have been successful in

blocking generic market saturation with

claims of superior safety. Together, the five most commonly used drugs, all generics, captured 55.1% of market share.

Top Drugs

generIc fIll raTe (gfr)

by MarKet share

A study showed that 78.5% of patients

prescribed pregabalin treatment for neuropathic

pain discontinued therapy within one year.14

oxycodone/acetaminophen

1.127 NUMBER OF PRESCRIPTIONS

$40.82 AVERAGE COST

22.7% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

hIgh BlooD

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

pMpy spenD

unIT cosT

Per-member-per-year (PMPY) spend for

High Blood Cholesterol

medications used to treat high blood

pressure/heart disease decreased 12.6%,

to $36.06, driven by a 12.2% decrease in

High Blood Pressure/Heart Disease

unit cost. Generic medications made up

Heartburn/Ulcer Disease

93.5% of total 2014 market share, in part

due to the final approval and subsequent

Attention Disorders

launch of generics to brand Diovan®

(valsartan), which legal issues had

delayed more than a year. The number

of PMPY prescriptions for high blood pressure/heart disease medications was the highest among the traditional therapy classes in the top 10.

Top Drugs

generIc fIll raTe (gfr)

by MarKet share

2.493NUMBER OF PRESCRIPTIONS

$14.46 AVERAGE COST

16.9% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

Per-member-per-year (PMPY) spend for

pMpy spenD

unIT cosT

medications used to treat heartburn and

ulcer diseases such as gastroesophageal

High Blood Cholesterol

reflux disease (GERD) decreased 10.6%, to

$33.40, fueled by a 9.2% decrease in unit

cost and a 1.4% decline in utilization. The

High Blood Pressure/Heart Disease

decline in utilization is due primarily to a

Heartburn/Ulcer Disease

shift to the over-the-counter (OTC) version

of Nexium® (esomeprazole magnesium),

Attention Disorders

which became available in May 2014.

With generic medications now making up

77.0% of total market share in the class,

it is not surprising that the average cost per prescription dropped from $62.08 in 2013 to $56.26 in 2014.

Top Drugs

generIc fIll raTe (gfr)

by MarKet share

A recent review of studies examining the

utilization of proton pump inhibitors (PPIs)

Nexium® (esomeprazole magnesium)

suggests that adherence among patients using

pantoprazole ranitidine

PPI ranges between 53.8% and 67.7%.15

0.594NUMBER OF PRESCRIPTIONS

$56.26 AVERAGE COST

8.3% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

Although the generic fill rate (GFR) for asthma medications was the lowest of

any top 10 traditional therapy class,

pMpy spenD

unIT cosT

per-member-per-year (PMPY) spend for

asthma medications dropped 14.9%

High Blood Cholesterol

in 2014, to $29.59, due primarily to an

11.6% decrease in unit cost. Asthma

also dropped in rank from the fifth to

High Blood Pressure/Heart Disease

the seventh most expensive therapy

Heartburn/Ulcer Disease

class from 2013 to 2014. Montelukast,

the generic formulation of Singulair®,

Attention Disorders

continued to capture more market share

than any other medication. Asthma

medications had a relatively high

average cost per prescription in 2014, although two of the five most commonly used drugs in the class were generics.

Top Drugs

generIc fIll raTe (gfr)

by MarKet share

54.9% of adult patients and

montelukast Proair® HFA (albuterol)

78.3% of pediatric patients are

Ventolin® HFA (albuterol) Symbicort (budesonide/formoterol)

nonadherent to medication therapy.

0.431NUMBER OF PRESCRIPTIONS

$68.60 AVERAGE COST

8.8% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

aTTenTIon

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

Per-member-per-year (PMPY) spend for

pMpy spenD

unIT cosT

medications used to treat attention

disorders increased 6.3% in 2014,

High Blood Cholesterol

driven by a 3.4% increase in utilization

and a 2.9% increase in unit cost. A non-

controlled drug, Intuniv™ (guanfacine),

High Blood Pressure/Heart Disease

first approved in 1986 as the blood

Heartburn/Ulcer Disease

pressure medication Tenex®, was

reapproved in September 2009 as an

Attention Disorders

extended-release product for attention

deficit hyperactive disorder (ADHD). The

first generic for Intuniv entered the U.S.

market in December 2014, and others are expected to launch in mid-2015.

Top Drugs

generIc fIll raTe (gfr)

by MarKet share

Recent research suggests that medication

adherence may be less than 12% in adult

ADHD patients taking stimulant medications

Strattera® (atomoxetine)IntunivTM (guanfacine)

such as methylphenidate.16

0.222NUMBER OF PRESCRIPTIONS

$126.11 AVERAGE COST

2.6% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

Utilization of medications used to treat depression increased 2.1%, but a

20.5% decrease in unit cost contributed

pMpy spenD

unIT cosT

significantly to negative overall trend.

Recent literature has noted rising use

High Blood Cholesterol

of antidepressants due to increases

in both the prevalence of depression

and the duration of therapy for the

High Blood Pressure/Heart Disease

condition.17 In 2014 alone, the generic

Heartburn/Ulcer Disease

fill rate (GFR) for the depression therapy

class climbed from 88.4% to 95.9%,

Attention Disorders

and only one brand drug, Viibryd®

(vilazodone), remains among the top

10 most commonly used medications in

Top Drugs

generIc fIll raTe (gfr)

by MarKet share

sertralinebupropion extended release

0.905NUMBER OF PRESCRIPTIONS

$28.72 AVERAGE COST

10.0% PREVALENCE

TrADiTionAl spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 TraDITIonal Therapy classes

ranKed by 2014 PMPy sPend

pMpy spenD

unIT cosT

A significant increase in unit cost (9.6%)

High Blood Cholesterol

contributed to the 9.1% increase in

per-member-per-year (PMPY) spend for

mental/neurological disorders treatments

High Blood Pressure/Heart Disease

in 2014. An antipsychotic, Abilify®

Heartburn/Ulcer Disease

(aripiprazole), which captured 16.3%

of market share in 2014, faces the

Attention Disorders

impending loss of patent protection in

April 2015 and experienced a significant

increase in unit cost. Price increases

often are seen in the months before a brand drug's patent expires.

Top Drugs

generIc fIll raTe (gfr)

by MarKet share

Abilify® (aripiprazole)

donepezil lithium

0.118NUMBER OF PRESCRIPTIONS

$209.96 AVERAGE COST

1.5% PREVALENCE

TherApy cl Ass review

Top 10 TraDITIonal Drugs

ine of the top 10 drugs when ranked by PMPY spend in 2014 were branded

Although total trend for Nexium

medications, accounting for 18.4% of total traditional spend. The lone generic,

N duloxetine, the active ingredient in Cymbalta®, climbed to sixth place in its was -5.7%, it remained as the most

first full year of availability. Cymbalta's patent expired in December 2013 and duloxetine's

expensive traditional drug therapy used

total trend was 2,010.7%, reflecting the ongoing utilization switch from the branded formulation of Cymbalta to the generic formulation throughout 2014 (the generic was

by commercially insured beneficiaries.

only available for a short time in 2013). Nexium again had the highest PMPY spend at $24.02, followed by Crestor at $17.89. Among the top 10, utilization trend was marginally or significantly negative for seven drugs, but all except duloxetine showed at least a 3.9% increase in unit cost, with the highest for Humalog, at 36.1%.

Top 10 TraDITIonal Therapy Drugs

ranKed by 2014 PMPy sPend

% of ToTal

Drug naMe

pMpy spenD TraDITIonal spenD

unIT cosT

Nexium® (esomeprazole magnesium)

Crestor® (rosuvastatin)

High Blood Pressure/Heart Disease

Lantus® (insulin glargine)

Abilify® (aripiprazole)

Humalog® (insulin lispro)

OneTouch Ultra® Test Strips

AndroGel® (testosterone gel)

Hormonal Supplementation

Lialda® (mesalamine)

Inflammatory Conditions

Januvia® (sitagliptin)

TherApy cl Ass review

coMMercIally InsureD: specIalTy Therapy classes anD InsIghTs

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

pMpy spenD

unIT cosT

Inflammatory Conditions

Multiple Sclerosis

Miscellaneous Specialty Conditions

Growth Deficiency

Pulmonary Arterial Hypertension

er-member-per-year (PMPY) spend for the top three specialty therapy classes –

from the top 10. For the first time, drugs used for primary prevention and treatment of

inflammatory conditions, multiple sclerosis and oncology – contributed 55.9%

acute bleeding in hemophilia patients were among the most expensive specialty classes

P of the spend for all specialty medications billed through the pharmacy benefit

ranked by PMPY spend.

in 2014. Drugs for inflammatory conditions (such as rheumatoid arthritis and psoriasis) continued to hold the top spot. The class of drugs used to treat hepatitis C was not even among the top 10 specialty classes in 2013. However, just three hepatitis C medications –

The class of drugs used to treat hepatitis C was not even among the

Sovaldi® (sofosbuvir), Olysio® (simeprevir) and Harvoni® (ledipasvir/sofosbuvir) made up

top 10 specialty classes in 2013. However, just three hepatitis C

96.4% of total hepatitis C spend and 11.8% of total specialty spend, propelling the class

medications – Sovaldi® (sofosbuvir), Olysio® (simeprevir) and

to the fourth most expensive specialty therapy class. In 2014, decreased spend for specialty

Harvoni® (ledipasvir/sofosbuvir) – made up 96.4% of total

anticoagulant medications, combined with significant growth in unit cost for drugs that

Hepatitis C spend and 11.8% of total specialty spend.

treat and prevent hemophilia episodes, led to the displacement of specialty anticoagulants

TherApy cl Ass review

• Increases in both utilization and unit cost of oncology medications contributed to a

20.7% increase in PMPY spend for the therapy class. With new, highly targeted therapies increasingly being approved, oncology drugs continue to rank among the most expensive therapies; but growth in spending is tempered by the fact that many of the new drugs are indicated for rare types of cancer. The utilization increase likely is related to advances in cancer survivorship – more patients are living longer with some types of the disease, which now often can be treated like chronic illnesses that require ongoing therapy.

• The 35.6% increase in total spend for medications used to treat miscellaneous specialty

conditions – many of which are orphan conditions, including narcolepsy, nephropathic cystinosis and chorea associated with Huntington disease – is attributable primarily to increases in the costs of individual drugs. Drug costs continue to rise as manufacturers provide products to captive patient populations with few other options.

• Trend for hemophilia medications was 16.9% in 2014, driven by a double-digit increase

in unit costs. Two-thirds of market share in this class is captured by formulations of desmopressin, a generic medication frequently used for milder cases. Brand inflation occurred for clotting factors such as BeneFix® (coagulation factor IX [recombinant)] and

Specialty medications accounted for

Feiba NF (anti-inhibitor coagulation complex), helping drive an increase in unit cost.

more than 31% of total drug spend

• Spend for transplant-rejection medications continued to decline in 2014, dropping

2.3% due in large part to the increasing availability of lower-cost generic formulations.

in 2014, up from 27.7% in 2013.

In January 2014, two of the few remaining brand immunosuppressant drugs for post-transplant use, Myfortic® (mycophenolic acid) and Rapamune® 0.5mg tablets (sirolimus), lost patent protection, contributing significantly to the 86.1% generic fill rate (GFR) in this therapy class.

speciAlT y spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

Inflammatory conditions was the most

pMpy spenD

unIT cosT

expensive specialty therapy class for the

Inflammatory Conditions

sixth year in a row, resulting from an 8.5%

Multiple Sclerosis

increase in utilization and a 15.7% increase

in unit cost. The greater utilization is due

to the prevalence of rheumatoid arthritis

(RA), the most common condition these

Miscellaneous Specialty Conditions

medications treat, and an expansion

Growth Deficiency

in approved indications for some of the most commonly used drugs in the class.

The 15.7% increase in unit cost is likely

Pulmonary Arterial Hypertension

related to typical brand inflation. Two

drugs with multiple indications, Humira®

(adalimumab) and Enbrel® (etanercept), continued to account for more than 80% of market share. Doubling its market share from 2013 to 2014 was Xeljanz®

Top Drugs

(tofacitinib), the only oral disease modifying

by MarKet share

anti-rheumatic drug indicated to treat RA

that has not responded to other therapies.

Humira® (adalimumab)

At the time of approval by the FDA in 2012,

Enbrel® (etanercept)

questions concerning its safety profile made

Stelara® (ustekinumab)

its place in therapy unclear. As longer-term

Orencia® (abatacept)Cimzia® (certolizumab)

safety and effectiveness data have become

available, however, prescribers and patients are more accepting of using Xeljanz.

0.027NUMBER OF PRESCRIPTIONS

$2,913.33 AVERAGE COST

0.3% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

MulTIple

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

A 9.7% increase in unit cost was the

pMpy spenD

unIT cosT

key driver of the 12.9% increase in per-

Inflammatory Conditions

member-per-year (PMPY) spend for

Multiple Sclerosis

multiple sclerosis (MS) medications.

New oral medications continue to change

the treatment landscape in this therapy

class. Together, Tecfidera® (dimethyl

Miscellaneous Specialty Conditions

fumarate, approved in 2013) and Gilenya®

Growth Deficiency

(fingolimod, approved in 2010) captured

29.8% of market share in 2014. The new

Pulmonary Arterial Hypertension

longer-acting formulation of Copaxone®

(glatiramer) was the class leader with

29.7% of market share. A new interferon product, Plegridy™ (peginterferon beta-1a), received approval by the FDA in August 2014 as a longer-lasting treatment

Top Drugs

for MS, but it has not impacted trend yet.

by MarKet share

Recommended dosing for Plegridy is once

every two weeks by subcutaneous injection,

Copaxone® (glatiramer)

rather than the weekly intramuscular

Tecfidera® (dimethyl fumarate)

dosing for Avonex

® (interferon beta-1a).

Avonex® (interferon beta-1a)Gilenya® (fingolimod)

The average cost per prescription in

Rebif® (interferon beta-1a)

this class increased 9.2% to $4,510.06 in 2014.

0.012NUMBER OF PRESCRIPTIONS

$4,510.06 AVERAGE COST

0.1% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

Per-member-per-year (PMPY) spend for oncology medications was $41.64

in 2014. Although the increase in

pMpy spenD

unIT cosT

spend for this class of medications

Inflammatory Conditions

has slowed in comparison to the PMPY

Multiple Sclerosis

trend observed in previous years, trend

was still 20.7% in 2014, spurred by

an 8.9% increase in utilization and

an 11.7% increase in unit cost. Unit

Miscellaneous Specialty Conditions

cost increases for Gleevec® (imatinib),

Growth Deficiency

which captured 12.5% of market share,

and Revlimid® (lenalidomide), which

Pulmonary Arterial Hypertension

captured 10.8% of market share, were

prime contributors. Temozolomide, a

generic for Temodar® that launched in 2013, continued to capture market share. In addition, generics to Xeloda®

Top Drugs

38.2% of patients

(capecitabine) that were launched in 2014 were the fourth most commonly

by MarKet share

are nonadherent to

used oncology medications for the year.

However, nine new branded oncology

medication therapy

Gleevec® (imatinib)Revlimid® (lenalidomide)

therapies that were approved for use in

Lupron Depot® (leuprolide)

(oral oncology).

2014 are likely to have an impact on the

class going forward.

0.007NUMBER OF PRESCRIPTIONS

$6,191.29 AVERAGE COST

0.1% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

hepaTITIs c

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

Per-member-per-year (PMPY) spend for hepatitis C medications increased

742.6% to $37.95 in 2014, propelling

pMpy spenD

unIT cosT

this class of drugs to the fourth most

Inflammatory Conditions

expensive specialty therapy class when

Multiple Sclerosis

ranked by PMPY spend. Hepatitis C

medications did not rank in the top 10

list in 2013. These changes were driven

entirely by newly approved clinical

Miscellaneous Specialty Conditions

breakthroughs for the treatment of

Growth Deficiency

hepatitis C. Sovaldi® (sofosbuvir) and

Olysio® (simeprevir) that were approved

Pulmonary Arterial Hypertension

in 2013 along with Harvoni® (ledipasvir/

sofosbuvir), approved in October 2014,

jumped into the top five for the class. This new generation of oral antiviral medications offers clinical benefits that

Top Drugs

are superior to earlier therapies. Their price tags, however, are unsustainable.

by MarKet share

At approximately $84,000 for one

12-week course of treatment, Sovaldi

Sovaldi® (sofosbuvir)ribavirin

alone captured 37.5% of the 2014

Olysio® (simeprevir)

market share for hepatitis C.

Pegasys® (peginterferon alfa-2a)Harvoni® (ledipasvir/sofosbuvir)

0.002NUMBER OF PRESCRIPTIONS

$16,373.40 AVERAGE COST

0.03% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

Per-member-per-year (PMPY) spend for HIV medications increased 14.8% from

2013 to 2014, primarily due to a 10.3%

pMpy spenD

unIT cosT

increase in unit cost. The average cost

Inflammatory Conditions

per prescription for more than two-thirds

Multiple Sclerosis

of the HIV medications on the market in

2014 exceeded $1,000 per prescription,

compared with slightly more than half

of the HIV medications on the market

Miscellaneous Specialty Conditions

in 2013. The 10 most commonly used

Growth Deficiency

medications were all branded drugs;

the top two were combination therapies

Pulmonary Arterial Hypertension

that each contain more than one active

ingredient in a single pill.

Top Drugs

by MarKet share

Isentress® (raltegravir)Viread® (tenofovir)

0.024NUMBER OF PRESCRIPTIONS

$1,138.48 AVERAGE COST

0.14% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

specIalTy

ranKed by 2014 PMPy sPend

pMpy spenD

unIT cosT

Inflammatory Conditions

The class of medications used to

Multiple Sclerosis

treat an assortment of specialty

conditions, many of them orphan

diseases, is ranked sixth in the top

10 most expensive specialty therapy

Miscellaneous Specialty Conditions

class for 2014. The class includes

Growth Deficiency

Xenazine® (tetrabenazine), used to treat

Huntington's disease; Xyrem® (sodium

Pulmonary Arterial Hypertension

oxybate), used to treat narcolepsy; and

Arestin® (minocycline), used to treat

periodontal disease. Many medications in this class are only available through a limited network of specialty pharmacies. Several medications in this therapy class

Top Drugs

Nearly 40% of

also have substantial average costs per prescription, but a 27.3% increase

by MarKet share

the drugs in this

in utilization in 2014 mainly drove the

therapy class have

35.6% total trend – the second highest

Xyrem® (sodium oxybate)

of the specialty therapy classes in the

Arestin® (minocycline)

been approved as

top 10. The five most commonly used

medications captured 83.2% of the

market share in this therapy class.

0.002NUMBER OF PRESCRIPTIONS

$4,539.50 AVERAGE COST

0.06% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

The utilization of medications indicated

pMpy spenD

unIT cosT

to treat growth deficiency decreased by

Inflammatory Conditions

almost 1% in 2014, but a 7.5% increase

Multiple Sclerosis

in unit cost resulted in a 6.6% increase

in per-member-per-year (PMPY) spend.

Norditropin® FlexPro® (somatropin),

whose market share continues to grow

Miscellaneous Specialty Conditions

year-over-year, was the most commonly

Growth Deficiency

used medication in this class in

2014. The top two drugs in this class

Pulmonary Arterial Hypertension

accounted for more than two-thirds of

market share. The overall prevalence

of human growth hormone use, however, remained extremely low. Less than 0.05% of commercially insured beneficiaries filled a prescription for one

Top Drugs

of these medications in 2014.

by MarKet share

Norditropin® FlexPro® (somatropin)

Genotropin® (somatropin)Humatrope® (somatropin)

Omnitrope® (somatropin)Norditropin® NordiFlex® (somatropin)

0.003NUMBER OF PRESCRIPTIONS

$3,852.58 AVERAGE COST

0.03% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

The steady increase in spend for hemophilia drugs brought the class into

the top 10 most-expensive specialty

pMpy spenD

unIT cosT

therapy classes when ranked by

Inflammatory Conditions

per-member-per-year (PMPY) spend.

Multiple Sclerosis

With a 16.9% trend, spend for

hemophilia is increasing at a faster

rate than that for drugs used to treat

much more common conditions, such

Miscellaneous Specialty Conditions

as multiple sclerosis and HIV. Trend was

Growth Deficiency

driven by a 17.6% increase in unit costs.

Desmopressin captured two-thirds of

Pulmonary Arterial Hypertension

the market share in this class.

Top Drugs

A review of studies of hemophilia

by MarKet share

patients using prophylactic therapy

suggests that age and the presence

of symptoms were significantly related

Advate [antihemophilic factor (recombinant)] Stimate® (desmopressin nasal spray)DDAVP® (desmopressin)

to medication adherence.18

Kogenate® FS [antihemophilic factor (recombinant)]

0.001NUMBER OF PRESCRIPTIONS

$7,519.16 AVERAGE COST

0.01% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

pulMonary

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

arTerIal

ranKed by 2014 PMPy sPend

pMpy spenD

unIT cosT

Inflammatory Conditions

Following a relatively flat trend in

Multiple Sclerosis

2013, spend for pulmonary arterial

hypertension treatments increased

13.8% in 2014, with increases in

utilization and cost contributing equally.

Miscellaneous Specialty Conditions

Much of the increased utilization for

Growth Deficiency

the class is related to the 2012 patent

expiration for Revatio® (sildenafil).

Pulmonary Arterial Hypertension

Top Drugs

by MarKet share

Adcirca® (tadalafil)Tracleer® (bosentan)

Letairis® (ambrisentan)Revatio® (sildenafil)

0.001NUMBER OF PRESCRIPTIONS

$4,023.23 AVERAGE COST

0.01% PREVALENCE

speciAlT y spenD rAnk

TherApy cl Ass review

coMponenTs of TrenD for The Top 10 specIalTy Therapy classes

ranKed by 2014 PMPy sPend

Per-member-per-year (PMPY) spend for medications used to prevent organ-

transplant rejection decreased 2.3%

pMpy spenD

unIT cosT

between 2013 and 2014. The unit cost

Inflammatory Conditions

trend was the primary reason, stemming

Multiple Sclerosis

from market saturation of generic

drugs in the class. Generic medications

captured more than 85% of total market

share in 2014. Accordingly, the average

Miscellaneous Specialty Conditions

cost per prescription for transplant

Growth Deficiency

medications was lower than that of

any other specialty therapy class. A

Pulmonary Arterial Hypertension

new extended-release formulation of

tacrolimus, Astagraf XL® (tacrolimus

extended release), was approved in July 2013 for use in kidney transplant patients, but it had little impact in

Top Drugs

the class. Generics to Rapamune® 0.5mg tablets (sirolimus) and Myfortic®

by MarKet share

(mycophenolic acid delayed-release

tablets) were also launched in 2014.

Prograf® (tacrolimus)cyclosporine modified

0.025NUMBER OF PRESCRIPTIONS

$208.00 AVERAGE COST

0.2% PREVALENCE

TherApy cl Ass review

Top 10 specIalTy Drugs

espite a decrease in utilization for half of the drugs in the top 10 when ranked by per-member-per-year (PMPY) spend, the unit cost for all top-10 drugs increased

D at least 6%. Two of the new hepatitis C drugs ranked in the top 10 most-expensive

drugs, even though each had been on the market for only a little over a year. Sovaldi and Olysio had the largest increases in utilization, unit cost and total trend. Part of the magnitude of increase is related to these two drugs having only been available for a single month in 2013.

Tecfidera, an oral MS treatment,

In these two cases, just one month's utilization in 2013 was compared to 12 months' worth of utilization in 2014. Sovaldi treats far fewer patients than the most-expensive and second-

had a total trend of 152.1%, driven

most-expensive specialty drugs when ranked by PMPY spend, Humira and Enbrel, which also

by a triple-digit increase in utilization.

ranked among the costliest specialty medications. Olysio ranked 10th. Three drugs used to treat multiple sclerosis (MS) were also among the most-expensive single therapies in 2014, ranked by PMPY spend. Tecfidera, an oral MS treatment, had a total trend of 152.1%, driven by a triple-digit increase in utilization. Two oncology drugs and one drug for HIV rounded out the most-expensive specialty drugs for 2014.

Top 10 specIalTy Therapy Drugs

ranKed by 2014 PMPy sPend

% of ToTal

Drug naMe

pMpy spenD

unIT cosT

Humira® (adalimumab)

Inflammatory Conditions

Enbrel® (etanercept)

Inflammatory Conditions

Sovaldi® (sofosbuvir)

Copaxone® (glatiramer)

Multiple Sclerosis

Tecfidera® (dimethyl fumarate)

Multiple Sclerosis

Avonex® (interferon beta-1a)

Multiple Sclerosis

Gleevec® (imatinib)

Olysio® (simeprevir)

2015-2017 TrenD forecasT

2015-2017 TrenD ForecAsT

spenD for TraDITIonal Drugs

In The nexT Three years

n 2014, the trend for traditional drugs was 6.4%, with per-member-per-

2015-2017 TrenD forecasT

year (PMPY) spend at $668.75. We anticipate that traditional trend will

I decline modestly in 2015 and then increase moderately in both 2016 and

2017. The significant increase in spend for traditional drugs in 2014 was driven by

an unprecedented explosion in spend for compounded medications. The utilization of

traditional medications is likely to increase, but the continuing decline in overall costs related to an abundance of generics and a relative lack of brand innovators in the pipeline for the most commonly used therapy classes (aside from diabetes) will keep traditional

Top TraDITIonal Therapy classes

drug spend from increasing substantially. In fact, trend for five of the top therapy classes – high blood cholesterol, compounded medications, high blood pressure/heart disease,

2015 - 2017

heartburn/ulcer disease and depression – is expected to be negative in 2015. The class

of mental/neurological disorders will have a negative total trend in 2016 and 2017. The

largest increases in the next three years are expected for only two classes – diabetes, which

will continue to experience a slight increase in utilization along with escalating brand

High Blood Cholesterol

inflation, and anticoagulants, which will continue to capture market share from specialty

Compounded Medications

anticoagulants such as enoxaparin and fondaparinux.

High Blood Pressure/Heart Disease

Heartburn/Ulcer Disease

PMPY drug spend for diabetes medications is expected to increase 18.3% in each of the

Attention Disorders

next three years. Although only slight year-over-year increases in utilization are projected,

substantial continued increases in unit cost are likely to come from brand innovation,

steady inflation for branded drugs and switches from older generic monotherapies to newer

combination products. In addition, new, longer-acting dipeptidyl peptidase-4 (DPP-4) and

human glucagon-like peptide (GLP-1) formulations are in the development pipeline. Although

Other Traditional Classes

they will carry lower risks of causing hypoglycemia at night, they may be priced higher than

similar drugs that are currently available. Finally, biosimilars to some types of insulin also are likely to enter the market in the near future, but the impact will not be felt immediately because physicians may be reluctant to change insulins for patients whose diabetes is under control. No significant patent expirations are expected in the next few years.

2015-2017 TrenD ForecAsT

high BlooD cholesTerol

Per-member-per-year (PMPY) spend for the class is forecast to decline for the next several

For medications used to treat pain and inflammation, PMPY spend is forecast to rise

years as a result of decreases in both drug costs and utilization. The January 2016 expiration

moderately in each of the next several years, driven almost entirely by an increase in unit

of the patent for Crestor® (rosuvastatin) is likely to drive down PMPY spend in 2016.

cost. Short-term use of opioids has shown a steady pattern of decline over the past five

Patent expirations for Zetia® (ezetimibe) and Vytorin® (ezetimibe/simvastatin) in 2017 are

years. The Drug Enforcement Administration (DEA) reclassification of all hydrocodone

expected to spur an even faster decline in spend. Although guidelines for the primary and

combination products to schedule II controlled substances in October 2014 also may

secondary prevention of atherosclerotic cardiovascular disease and events, published in

contribute to lower utilization. Drops in utilization are attenuated by the influx of branded,

late 2013, call for treatment based on risk factors rather than for the achievement of

tamper-resistant formulations of older medications, such as OxyContin® (oxycodone), that

specific cholesterol levels, significant changes in prescribing patterns have yet to be seen.

replace or compete with non-abuse-deterrent generically available options. In addition,

Although expensive new treatments known as proprotein convertase subtilisin/kexin type 9

shortages of oxycodone/acetaminophen products may continue to elevate generic prices.

(PCSK9) inhibitors that are in the development pipeline may be an alternative to statins,

Celebrex® (celecoxib), a nonsteroidal anti-inflammatory drug, lost patent protection in

they will be considered specialty medications. Therefore, they will not have a significant

2014. Because it captured so much market share, the lower cost of generic celecoxib

direct impact on traditional spend for high blood cholesterol therapies. A focus on cost

compared to brand Celebrex is likely to decrease spend for the class as a whole; but the

when PCSK9 inhibitors are introduced, however, may lead to an increase in the utilization of

drop will be offset fully by increases in prices for other drugs in this class.

traditional cholesterol-lowering drugs among patients who are not currently being treated. However, any increases in utilization as a result will not offset the steep drops in drug costs for existing traditional high blood cholesterol treatments.

The lower cost of generic celecoxib is likely to decrease spend for

the class, but the drop will be offset fully by increases in prices

for other drugs in the class.

Spend for compounded medications is expected to decline sharply in 2015, and then to increase again to a much more sustainable rate of 8% growth in both 2016 and 2017.

high BlooD pressure/heArT DiseAse

Clients that implemented the compound-utilization management solution in 2014 were able to substantially control the continuing increase in cost. However, only about 60% of

The forecast decline in PMPY spend for medications used to treat high blood pressure is

clients implemented the program by the end of 2014. The negative trend in 2015 is expected

expected to result from stagnant utilization and the release of more generics in the class.

because clients that implemented the program in 2014 will realize more than a full-year

Generics to Diovan® (valsartan), which lost patent protection in 2012, were delayed for

reduction in spend by the end of 2015, and additional clients are expected to implement

nearly two years due to legal issues. The release of the first Diovan generic in June 2014,

the program by the end of the year. The drop in spend is likely to be driven exclusively by a

followed by several others in December, is expected to have a continuing impact on spend

drop in utilization, as there is no expectation that the price increases seen for compounded

throughout 2015. Four of the remaining brand drugs – Azor® (amlodipine/olmesartan),

medications will abate. The utilization-management program is expected to have maximum

Benicar® (olmesartan), Benicar HCT® (olmesartan/hydrochlorothiazide) – and Tribenzor®

impact before 2016 and 2017, when PMPY drug spend is expected to increase moderately,

(amlodipine/olmesartan/hydrochlorothiazide) are set to lose patent protection late in 2016.

primarily as a result of drug inflation.

The resulting decline in spend is likely to be small, however, because together they account

2015-2017 TrenD ForecAsT

for less than one percent of market share. A new drug containing the angiotensin receptor

blocker valsartan and sacubitiril, the first in a new class called neprilysin inhibitors,

PMPY spend for medications used to treat attention disorders is forecast to increase in

could be submitted to the FDA for approval in 2015. Currently known as LCZ696, the drug

each of the next three years. Utilization will increase for adults diagnosed with attention

may have blockbuster potential and larger-than-expected adoption of it could impact

disorders and adults seeking improved ability to focus and concentrate, and utilization

trend considerably.

will continue for children and adolescents already using attention-disorder therapy. In February 2015, a new indication to treat binge-eating disorder was granted for Vyvanse®

(lisdexamfetamine), one of the most commonly used drugs in the class; as a result, utilization of Vyvanse is expected to increase. However increasing generic availability is

The large year-over-year negative trend forecast for medications used to treat

expected to slow the rate of growth in unit costs. Intuniv™ (guanfacine) went generic in

heartburn/ulcer disease is driven primarily by many less-expensive generic and over-the-

late 2014, and the patent for Strattera® (atomoxetine) will expire in 2017. Still, several of

counter (OTC) versions of the most commonly used medications in the class. Continuing

the convenient, once-daily attention disorder drugs will remain under patent protection for

decreases in PMPY spend from 2015 through 2017 are expected after the May 2014

several more years.

launch of Nexium® 24HR – an OTC version of the last remaining blockbuster drug in the class, Nexium® (esomeprazole magnesium) – began to erode prescription market share. Decreasing utilization of prescription medications as patients shift to OTC Nexium will have a significant impact on trend in 2015, followed by even larger impacts in 2016 and 2017.

The utilization of traditional medications is likely to increase, but

Generic Nexium, delayed by regulatory issues for eight months, finally reached the market

the continuing decline in overall costs related to an abundance of

in early 2015. No new drugs for heartburn/ulcer disease are in development and the few

generics and a relative lack of brand innovators in the pipeline for

remaining brands, such as Dexilant (dexlansoprazole), will have difficulty competing with

the most commonly used therapy classes (aside from diabetes) will

the many popular generic and OTC options.

keep traditional drug spend from increasing substantially.

PMPY spend for asthma medications is expected to increase again after the cost lowering

PMPY spend for medications used to treat depression is expected to decrease for the next

impact of the 2012 patent expiration for Singulair® (montelukast) abates in 2015. Brand

several years, due mainly to slight decreases in utilization and declines in drug costs as

inflation among inhalers will push up cost, while increased diagnosis and subsequent

generics become more available. The December 2013 launch of generics for one of the last

initiation of treatment for asthma and chronic obstructive pulmonary disease (COPD)

remaining brand serotonin and norepinephrine reuptake inhibitors, Cymbalta® (duloxetine),

will combine to raise PMPY spend. In addition, increased utilization is expected as new

will continue contributing to a significant decline in spend through 2015. But by 2016, the